Dissolution vs Liquidation - Don't lose your right to redundancy

Dissolving a company through a strike-off procedure (also known as dissolution) will invalidate a director redundancy claim. Here's what you need to know...

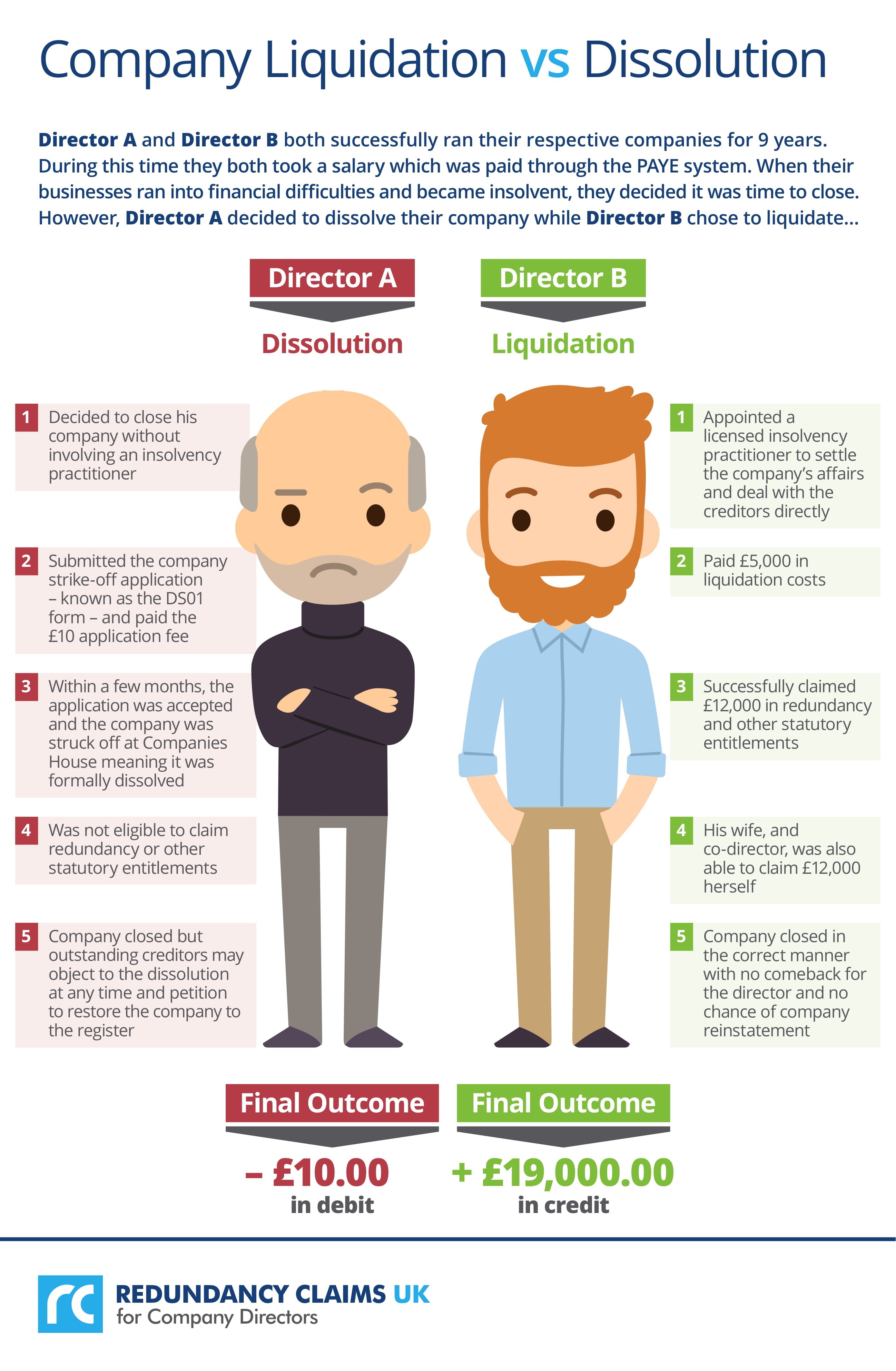

If you’re thinking of closing your company for financial reasons, or to relieve increasing creditor pressure, there are a couple of options open to you. One of these is entering a Creditors’ Voluntary Liquidation, or CVL, which involves the appointment of a licensed insolvency practitioner to realise and distribute your assets.

Some company directors feel the cost of this option is prohibitive due to the professional fees involved, so they decide to take a different route – company dissolution. Dissolving your own company costs very little to execute in financial terms, but when you look at the deeper issues involved, it could cost you considerably more in the long-run, both financially and personally.

It will also invalidate a claim for director redundancy, of which the average pay-out is currently £9,000.

Significant drawbacks of company dissolution

Although the low strike-off fee for dissolving your company is a significant plus factor, there are strict rules that govern the dissolution procedure, one of which is solvency. If you attempt to follow through on this process knowing that you owe money to creditors, your application is likely to be rejected outright.

HMRC regularly challenge applications for dissolution made by company directors who are unaware of the full process and rules surrounding this procedure. It’s often the case that professional advice hasn’t been sought prior to applying to have their company struck off, and this leads to them making a bad decision.

Restoration to the register at Companies House

Even if your application for dissolution does go through unchallenged, the company can be restored to the register at a later date if an outstanding creditor discovers that it has been closed down. In these cases, the company is restored as if no dissolution has taken place, and the creditor is free to resume legal action to recover their debt.

This can lead to the Insolvency Service investigating you and your fellow directors for instances of wrongful and illegal trading, or other cases of misconduct. Although Creditors’ Voluntary Liquidation also involves investigation by the liquidator, the fact that you’ve prioritised creditors by appointing an insolvency practitioner to deal with the closure of your company is a significant factor in your favour.

Aside from the future implications of dissolution, however, one of the most compelling reasons to avoid the process should your company be insolvent is that you won’t be able to make a claim for director redundancy.

Voluntary liquidation and director redundancy

One of the main benefits of voluntarily placing your company into liquidation is that it keeps open the possibility of you being able to claim redundancy pay once your business closes. As a director, you may be entitled to make a claim for redundancy if you can prove your status as an employee of the company.

As we mentioned earlier, the average redundancy pay-out for a director is £9,000 - a significant sum which is likely to not only pay for the liquidation fees, but also leave some left over for you. A further benefit is that by formally liquidating your business, the company is closed irrefutably - there is no possibility of it being restored to the register in future, as is the case with company dissolution.

If you choose to enter a Creditors’ Voluntary Liquidation, in addition to redundancy pay you could be eligible for other statutory payments as an employee, including:

- Unpaid wages

- Arrears of holiday pay

- Pay in lieu of notice

Claim redundancy and close down your company

Closing a company with debts can be a highly complex process. The potential for your actions to be investigated if you use an inappropriate method of closure is extremely high; therefore it’s imperative to seek professional advice from licensed insolvency practitioners before you go any further.

Our experts at CFS Redundancy Payments Ltd have more than 30 years’ experience of insolvency and helping company directors claim the money they are entitled to. We’ll provide the professional advice you need to remain compliant, and ensure that you close your company using the most appropriate method. Call one of the team to learn more about director redundancy, and discover how much you may be eligible to claim. CFS are Authorised and Regulated by the Financial Conduct Authority. Authorisation No 830857. You can check our registration here.

Our experienced, industry-leading team are on-hand to help.

Myles Addison

Advisor